The countdown began today in view of the quarterly accounts that Unicredit will feed the markets on Thursday 6 May. The market today rewarded the stock with strong purchases (+ 1.85% in the 8.72 euro area). Despite almost -3% in the last month, the balance from the beginning of the year for Unicredit remains largely positive (+ 14%).

First test since Orcel’s arrival

This will be the first important appointment since Andrea Orcel has been at the helm of the bank in Piazza Gae Aulenti. Investors await the banker at the gate on the sidelines of the accounts to get some first indications on the strategic choices he will carry out in the coming quarters, primarily on the M&A front. In recent months, many leads have emerged for Unicredit: from the possible takeover of MPS in the wake of the pressing of the Treasury, to a possible marriage with Banco BPM. Also waiting for any indications on the dividend front waiting to know if from October there will no longer be any ECB limitations on shareholder remuneration policies.

Preview of 1st quarter accounts and full 2021 estimates

In view of the board of directors on May 6 called to approve the accounts for the 1st quarter of 2021, the consensus of the analysts published in the bank website (information updated to 26 April) indicates a net profit of 413 million euros after adjustments on loans for 625 million. Revenues are seen at 4.28 billion, with an interest margin of 2.167 billion euros, with net commissions of 1.55 billion and estimated net operating income of 1.21 billion euros.

In terms of capital ratios, Cet1 is seen to rise slightly to 15.2% from 15.08% at the end of 2020.

Looking at the whole of 2021, the consensus indicates a net profit of 2.19 billion euros, net operating income of 4.1 billion after write-downs on loans for 3.24 billion. Cet1 at 13.87%.

Uncertainty about the future size of dividends

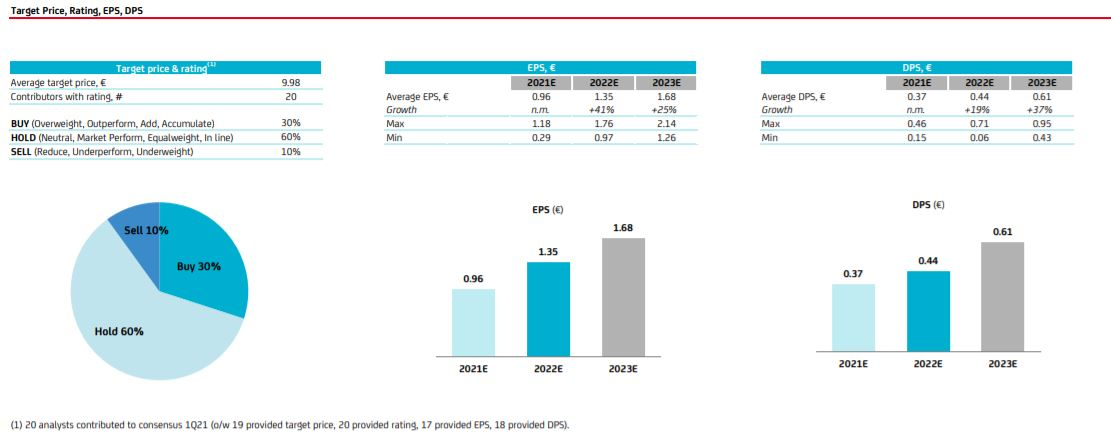

On the dividend front, among analysts there is a great variety of assessments on the size of the 2022 dividend (relating to the 2021 financial year): a coupon of € 0.37 per share is indicated (the range goes from 0.15 to 0.46 EUR). Dividend which should then rise to € 0.44 in 2022 and € 0.61 in 2023.

Among the analysts i Buy on Unicredit shares are equal to 30% of the total; 60% say Hold while 10% say Sell.