Billionaires pay $0 in taxes?Fancy tax avoidance law exposed US Treasury Department initiated investigation, White House responded

Comprehensive Red Star News and Xinhua News Agency news on Tuesday (June 8) local time, the non-profit news organization ProPublica released an “explosive” report. The agency claimed that they had exclusive access to a large number of secret documents from the Internal Revenue Service (IRS), which contained the tax information of Jeff Bezos, Warren Buffett and several of the world‘s wealthiest people.

This information shows that compared with their huge wealth, these global wealthy people pay pitifully little income tax each year. In some years, they even paid $0 in taxes.

ProPublica said that these tax records give people an unprecedented understanding of the financial situation of the wealthy Americans, including not only their income and taxes, but also their investment, stock trading, and gambling income, and reveal how they are “legitimate and reasonable.” Evasion of income tax.

ProPublica report screenshot

Subsequently, the Biden administration stated that it was investigating how the tax information was leaked.

Bezos earns $3.8 billion in annual taxes and pays $0, Buffett’s 24.3 billion tax rate is only 0.1%

ProPublica claims that it has acquired 15 years of massive data from the Commissioner of the Internal Revenue Service, involving the tax returns of thousands of the richest people in the United States. Tax information shows that almost every rich person has never paid federal income tax in some years.

In 2007, Jeff Bezos, the billionaire at the time and today’s richest man in the world, did not pay a penny of federal income tax, but his wealth increased by $3.8 billion. In 2011, he achieved this “feat” again. Bloomberg’s founder, Michael Bloomberg, has also done this in recent years. Investor “The Wolf of Wall Street” Karl Icahn paid zero taxes for two years. “Financial crocodile” George Soros did not pay federal income tax for three consecutive years from 2016 to 2018.

According to the U.S. tax law, middle-income households with an annual income of approximately $70,000 in the United States are currently required to pay 14% of the federal tax, while couples with an annual income of more than $628,300 should pay 37% of the income tax.

From 2014 to 2018, the wealth, income and tax data of the four richest people in the United States are compared. According to ProPublica

After comparing the annual tax payments of the 25 richest Americans with the wealth growth estimated by Forbes over the same period, ProPublica came up with a surprising result: the total wealth of these 25 people increased from 2014 to 2018. For 401 billion U.S. dollars, a total of 13.6 billion U.S. dollars in taxes were paid in five years, and the actual tax rate was only 3.4%. One of the most amazing is Buffett. His wealth has increased by US$24.3 billion in 5 years, but the data shows that he paid a total of US$23.7 million in taxes, and the actual tax rate was 0.1%. And now the world‘s richest man Bezos actually pays a tax rate of 0.98%.

However, the report pointed out that this does not mean that they are suspected of any illegal tax evasion. So, how exactly do these wealthy people achieve “legal and reasonable” tax avoidance?

Method 1: Hold a large amount of real estate and receive a salary of $1 per year

According to foreign media analysis, most of the wealth of these rich people comes from the soaring value of assets such as company stocks and real estate. However, under US law, unless these assets are sold, these proceeds are not taxable income. Therefore, for the wealthy, the wage income that really accounts for the bulk of taxation is only “rare and rare”, and some people even pay themselves a salary of only $1 a year.

According to data from the US Internal Revenue Service, the total salary of the 25 richest Americans in 2018 was $158 million, which is only 1.1% of their total income declared on their tax returns. Most of the rest comes from dividends and stocks, bonds or other investment income, but their tax rates are much lower than wage tax rates.

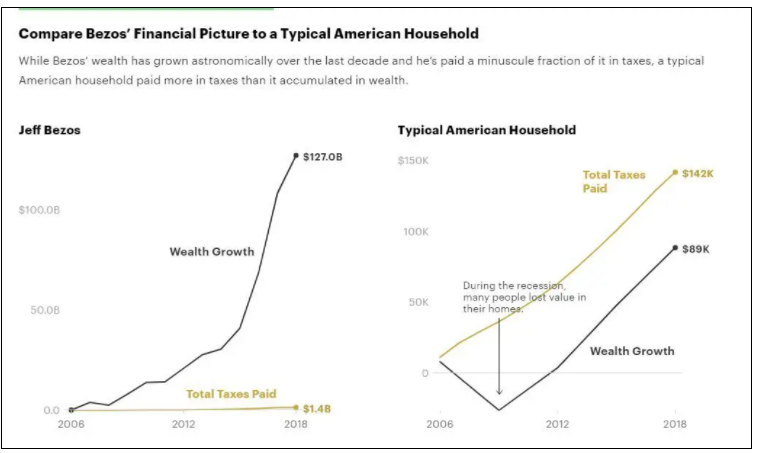

A comparison chart between Bezos (left) and the financial situation of a typical American family. From 2006 to 2018, for every $100 increase in wealth, the average American would have to pay $160 in taxes, while Bezos only paid $1.09. According to ProPublica

For example, Bezos’ salary has always been around US$80,000 per year, which is consistent with the level of the middle class in the United States. But since 2006, Amazon’s stock price has soared. In most years, Bezos’ wealth has grown far more than his income declared to the Internal Revenue Service. In contrast, most Americans who live on wages receive a direct tax deduction for almost every dollar of income.

ProPublica analyzed the data and concluded that between 2006 and 2018, for every $100 increase in wealth, the average American had to pay $160 in taxes, while Bezos only paid $1.09.

Method Two: Get tax credits for “being unable to make ends meet”

In addition, according to tax information, the losses declared by the rich in certain years can completely offset their income tax bills.

For example, in 2007, Bezos and his wife Mackenzie Scott jointly filed a tax return. Bezos reported only $46 million in income, mainly from interest and dividends from external investments. But at the same time, he used various deductions such as indirect investment losses and debt interest expenses to offset every penny earned.

In 2011, Bezos’ wealth was approximately US$18 billion, but the tax returns he submitted showed that his investment losses exceeded his income that year. What’s more worth mentioning is that, according to the US tax law, he has successfully applied for and received a tax credit of $4,000 for his children because of his “income is too low.”

The data obtained by ProPublica also shows that the super-rich have a variety of tax avoidance options, such as offsetting their income through credits and deductions (including charitable donations), thereby reducing or even making their tax bills zero.

For example, in 2018, Michael Bloomberg’s declared income was $1.9 billion. But he took advantage of the tax cuts adopted during the Trump administration, the $968.3 million in charitable donations, and the credit for paying foreign taxes to successfully cut his own taxes. In the end, he paid $70.7 million in income tax for the $1.9 billion in income, at a tax rate of about 3.7%.

Method 3: Mortgage assets and debts equal to making money

So, how can billionaires pay for their huge expenses while paying low salaries and not selling their stocks? According to public documents and experts, the answer may be to borrow a lot of money.

For ordinary people, borrowing money is usually out of need, such as buying a car or buying a house. But for these super-rich people, this may be a “coup” to get billions of assets without generating income or paying income tax.

The specific settlement method is as follows:

“If you own a company and hold a large annual salary, you have to pay 37% of the income tax on the annual salary. If you sell the stock, you have to pay 20% of the capital gains tax and lose some control of the company.

If you take a loan, you only need to pay single-digit interest, and you don’t have to pay taxes. And because this part of the loan must be repaid, the IRS will not count them as income. In general, the interest you pay to the bank is much less than the income tax that needs to be paid. All you need to do is to mortgage the assets to the bank, and these rich people have a lot of collateral. “

ProPublica said that because loans usually do not need to be disclosed to the IRS, most of these super-rich loans do not appear in tax records, but some records may appear in securities filings.

For example, in 2014, Oracle disclosed that its CEO Ellison would hold approximately $10 billion in stock as a guarantee for the credit line. Last year, Musk pledged about 92 million Tesla shares as collateral for personal loans. As of May 29, 2021, these shares are worth about 57.7 billion U.S. dollars.

The above content may only be the “tip of the ice” in the tax avoidance system of the super-rich. ProPublica said that in the next few months, it will use the data of the US Internal Revenue Service to study in more detail what these super-rich are really. How to evade taxes, exploit loopholes, and evade the review of federal audit agencies.

The US Treasury Department initiates an investigation into the White House’s response

According to Xinhua News Agency, the U.S. Treasury Department confirmed on the 8th that it has launched an investigation into the exposure of the tax information of many wealthy Americans in the National Revenue Service system by online news agencies.

Treasury Department spokesperson Lily Adams said: “It is illegal to disclose confidential government information without approval. This matter has been referred to the Office of the Inspector General of the Ministry of the Treasury, the Director of Tax Management, the Federal Bureau of Investigation and the Office of the Federal Attorney for the District of Columbia. Disposal, any party has the power of independent investigation.”

The State Administration of Taxation under the Ministry of Finance also launched an investigation.

White House Press Secretary Jane Psaki said on the 8th: “We take this matter very seriously.” She emphasized that the US government led by President Joseph Biden is committed to pushing the rich to pay more taxes.

In response to the report, a Soros spokesperson said that from 2016 to 2018, Soros made investment losses and there was no tax evasion, but Soros publicly supported the taxation of the rich.