Original title: Peak during the year! The 410 billion yuan sales restriction has been lifted. Do you need to be nervous?

Summary

[Peakduringtheyear!Isitnecessarytobenervouswhenthe410billionyuansalesrestrictionislifted?】LastweekthetradingsentimentintheA-sharemarketwasstillrelativelypositiveThenorthboundcapitalcontinuedtoflowinandthemarketvolumecouldcontinuetobereleasedIn3tradingdaystheturnoverexceeded1trillionyuanandtheactivityoffundsincreasedItisworthnotingthatthisweekAshareswillusherinthehighpointofthisyear’sliftingofthebanincludingtheeraoflithiumbatteryleaderNingdethestockwillhaveamarketvalueof410billionyuanthisweek

Last week, the trading sentiment in the A-share market was still relatively positive. The northbound capital continued to flow in, and the market volume could continue to be released. In 3 trading days, the turnover exceeded 1 trillion yuan, and the activity of funds increased.

It is worth noting that this week A shares will usher in the high point of this year’s lifting of the ban, including lithium battery leadersNingde era, The stock will have a market value of 410 billion yuan this week to lift the ban.

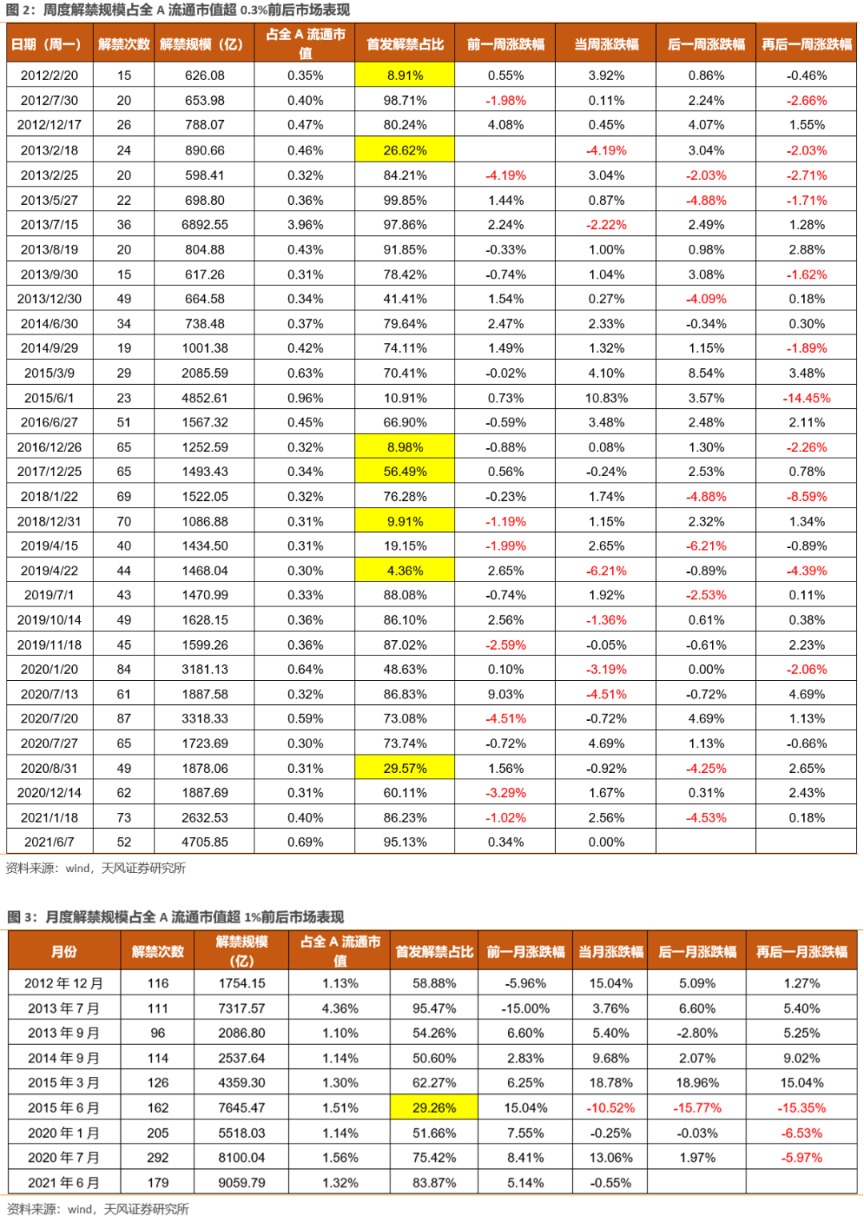

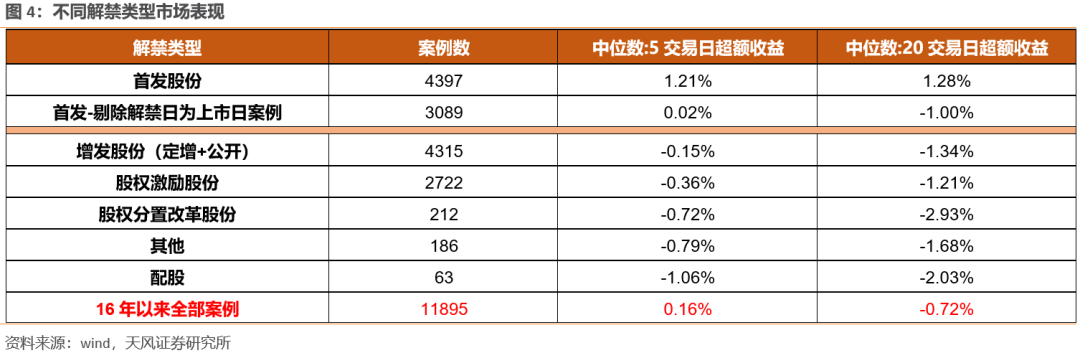

How will the lifting of the ban affect the market? In this regard, institutional analysis believes that, on the whole, the impact of the lifting peak on the A-share index level has no obvious law. In the individual case,Additional issuanceLifting of the ban and equity incentives The lifting of the ban has a significant impact on the trend of individual stocks, but the originalshareholderThe lifting of the ban will have relatively little impact on subsequent stock prices.

A shares will meet the high point of lifting the ban this week

The A-share market this week will usher in the biggest wave of lifting of the ban this year. According to the latest closing price, the market value of the lifting of the ban in a single week will reach 470.585 billion yuan. A total of 48 stocks are facing lifting of the ban, and the total volume of lifting of the ban is 6.547 billion shares.Among them, the largest amount of market value lifted isNingde era, The market value of the lifted ban is 411.629 billion yuan.

Tianfeng SecuritiesChief StrategyAnalystLiu Chenming’s analysis believes that historical data backtesting shows that, overall, the impact of the lifting peak on A-shares at the index level has no obvious law.

From the perspective of individual stocks, different types of lifting of the ban have different impacts on different types of individual stocks:

First, the lifting of the original shareholder’s ban has a small impact on the subsequent stock price; secondly, the lifting of the ban on additional issuance and the lifting of the equity incentive ban will have a greater impact on the subsequent stock price, especially if the ban has a higher proportion, the short-term impact is more obvious; finally, the valuation is relatively high After the lifting of the ban, the probability that the stock price will be negatively affected is also higher.

“Lack of core” focus on the semiconductor sector

For the specific configuration recommendations in the near future,Tianfeng SecuritiesI believe that at present, the first half of the two industries of military electronics, raw materials, and semiconductorsPerformanceIt is expected to continue to accelerate and maintain high growth throughout the year. In the first half of the year, its stock price performance was flat and deviated from the prosperity. However, with the continuous verification of performance, there is a high probability that excess returns may be realized in the second half of the year.

The strategy team of Yuekai Securities is also optimistic about the semiconductor theme. Chen Mengjie, chief strategy analyst at Yuekai Securities, said that the global “core shortage” has not been significantly alleviated, and the supply of the semiconductor industry chain still needs to be paid attention to. Under the state of market supply and demand mismatch, semiconductor-related topics have a certain upside.

Looking into the future, Yuekai Securities said that the current market is still in the stage of style rotation, hotspot switching speed is relatively fast, and the performance of each sector is more differentiated. The index will likely continue to fluctuate at a high level, focusing on whether the index can break upwards driven by trading volume, and focus on three main lines in the allocation direction: first, focus on the expected performance of the semi-annual report + low valuation sector; second, the layout boom The growth rate of the sector has growth attributes; the third is to focus on high-quality core assets that have a large range of early callbacks and are basically geared towards good quality.

“Inflation concerns” are about to fade

Haitong SecuritiesChief strategist Xun Yugen said that in the first five months of this year, the market as a whole was in a range-bound pattern, rising before the Spring Festival and falling sharply after the Spring Festival. The incentive for the market adjustment after the Spring Festival is investors’ concerns about rising inflation and tightening liquidity.

But looking forward to the second half of the year,Haitong SecuritiesIt is believed that domestic commodity prices have dropped significantly recently, and inflationary pressures will be low in the second half of the year, and Wind’s consensus expectation also shows thatPPIAfter “peaking” at 8.2% in May, the negative energy brought about by inflation will gradually fade. Therefore, the bull market pattern has not changed, and this round of market ROE (return on equity) is expected to rebound from the fourth quarter of 2021 to the first quarter of 2022. Leading high-quality companies represented by the Mao Index are still the best allocation direction; at the same time, the smart manufacturing sector, which has faster profit growth and conforms to the policy direction, will be more flexible.

Guotai JunanSecurities chief strategist Chen Xianshun also said that at the macro level, the vaccination rate is gradually increasing, and the global economy will move from a dislocation recovery to a resonant prosperity. The “peak” of inflation expectations caused by the gap in supply and demand is in sight.

At the same time, the micro-market transaction structure has improved significantly. On the one hand, valuation and earnings growth have moved from divergence to convergence, and a single transaction factor has weakened the effect of pushing up stock prices; on the other hand, the degree of micro-crowding has declined and the pressure on funding chips has improved. In the context of the easing of inflation expectations and the improvement of the stock structure, the upward force of the market is accumulating.

Northbound funding for eight consecutive weeksNet inflow

In terms of funds, the northbound funds continued their net buying trend last week, with a total net inflow of 8.888 billion yuan throughout the week, marking the eighth consecutive week of net buying. As of Friday, the net purchases of Northbound funds this year have reached 211.953 billion yuan, exceeding the net purchases of the entire year last year.

China Merchants SecuritiesZhang Xia’s strategy team analyzed that the strong performance of the RMB since May may be one of the reasons for the large inflow of northbound funds.From the perspective of plate distribution, ShanghaiShenzhen Stock ConnectThe standard ratio of the main board fell, and the ratio of the science and technology innovation board and the ChiNext standard increased.In terms of active position adjustment, northbound funds bought substantiallyfood and drink、bank, Household appliances, etc.; sell cars, mechanical equipment, electronics, etc.

If you look at it for a long time,China Merchants SecuritiesIt is believed that the industry sectors favored by northbound funds in the past two years are mainly the following categories:

First, those who have been buying continuously since 2020 and selling less during the period, typically such as the mismatch of supply and demand leading to price increasesChemical Industry, Electrical equipment in the new energy industry chain; second, since 2021, the risk appetite has improved significantly and the industry has been continuously bought, such as those with clear expectations for performance improvementbank, Pharmaceuticals with more adjustments in the previous period; third, industries that have been continuously sold since July 2020, but whose risk appetite has improved significantly in the near term, mainly includefood and drinkAnd the communications industry.

(Source: Shanghai Securities News)

(Editor in charge: DF358)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.

.